Q: What is the effort of raising capital to an Insurtech startup?

Christine: I am not raising capital as an Insurtech company, nor as a Fintech company. There are investors that will peg us as “additional health company”, there are investors that will peg us as Insurtech, or Fintech, company, and then there are investors that will look at us as a market place. We had an easier time with series A because of the market place. It is not common, and I am well aware of that. There is an awful amount of excitement around Fintech and insurance in general and obviously, what’s going on now with government and political aspects that we see in the media makes for more opportunity, as there is more chaos in our life, and more uncertainty around health insurance no matter where on the spectrum you are. Whether you get your insurance from your employer or on your own. On the insurance side, also, the public demonize them and it creates chaos for them; they are not sure what’s going on either.

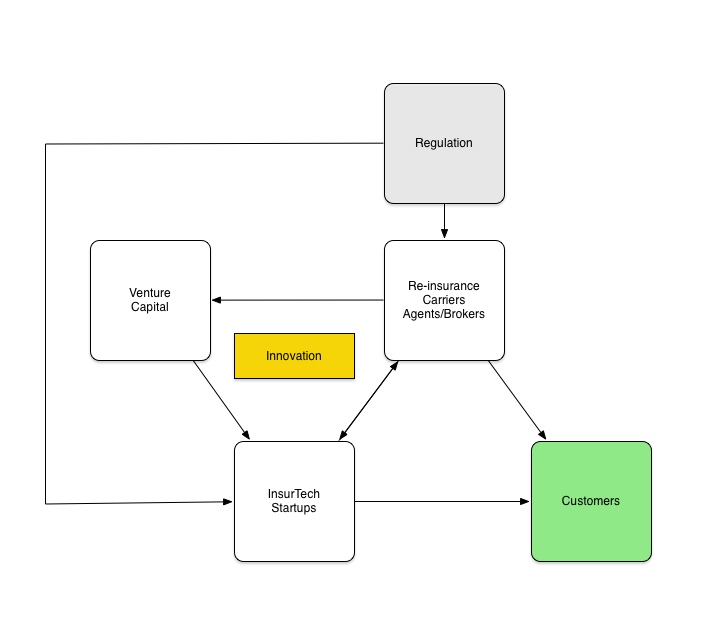

Colleen: broadly speaking, Insurtech has seen a lot of interest and momentum in the past 18-24 months. I would say that relative to other sectors and sub-sectors that we look at as part of the financial services. There is a pretty high velocity of new companies that are entering the space and getting funded. We look at credit, savings and investments and infrastructure products. Insurtech as a vertical is at the hockey stick curve which is where a lot of capital is getting it. We have seen this in other sectors. This is where we want many companies to be formed. We saw this phenomenon with payment in 2010-2012 and it happened in landing in 2012-2014. And now, and in the past year or two, it is with Insurtech. From our perspective, the volume of deals allows the best ideas to naturally rise to the top. Then we are capable of comparing a lot of business models and a lot of founding teams’ profiles. The downside is that there has been a lot of froffiness and many deals with evaluations that are completely decoupled from reality. In general, Christine’s matrix for series A is outstanding. In insurance, we see rounds that are a full step ahead from where they are in terms of traction. That means, they are a seed company and they raise an A evaluation, or they raise A series with B, or even C traction. These guys have yet to pile-up their capital stack, or their carrier or distribution partnerships, let alone proof of market fit. There are always buzzy deals that made done. We are going to see that a lot of the companies that got funded in the past two years will fail. I think that they will realize that customer acquisition is a lot harder than they originally thought. You can build a sleeker application funnel and a better streamline underwriting process, but at the end of the day, insurance is sold not bought. So, you need to create some sort of connection with the customer and a real channel hook to get them. A lot of the guys got into this space with a pure technology perspective and overlooked some of the more traditional dynamics around insurance. A lot will get burned because of that.

Q: We saw that in Q1 the investments dropped. Do you think it is a trend that the numbers are still strong if we ignore Zhong An and Hi Oscar?

Colleen: Yeah, that’s the thing. You have a few really big, sexy, high profile Insurtech deals that got done. I don’t want to speculate. We can take a look at the lending club. If there is a hiccup with one of the high profile companies, it freaks out the market. People get squeamish all the way down in the capital value chain. If you have a consumer lending startup, you are in a bad position because the market freaked out after Lending club, Prosper and OnDeck. If there is a public burnout of a company that raised hundreds of millions of dollars, that will ripple.

Q: Who are the investors in the space?

Colleen: The carriers are active for example XL and AmFm. Many carriers started a venture arm and are super active. Besides, a lot of the Fintech funds naturally migrated towards insurance. Because there are many similarities and efforts that run in parallel. Also, the generalists like Canaan, Foundation and more.

Q: Who are the Impact Health investors?

Christine: Our current investors are Birchmere ventures and Wavemaker, who are the bigger ones. We had several seed stages and raised capital from Charles Hudson, Precursor, and LaunchCapital.

Q: Are you raising more funds?

Christine: Yes, I am about to close series A with $10-15M. The recurring annual revenue is at $6.2M.

Q: How do you find the work with other investors and how do you differentiate yourself?

Colleen: I find it very collaborative, which may sound weird to people from the outside. People tend to be very open. There are deals that turn out to be highly competitive and then people throw elbows, but that’s maybe once a year. In general, I find that there are circles of people that I trust and they trust me, and we share what we are looking at, our thoughts and our notes. At the end of the day, the insurance fund space is very small so it is natural that you seek out colleagues to work with and collaborate.

In terms of how we differentiate ourselves, core innovation is a focus fund. In the case that we find a company that we like, we immediately demonstrate to them that we can add value. It can even be that we are not ready to invest in them at that moment, but maybe in a year or two. We show value by introducing them to talent, to business development and even introducing them to other investors.

Q: What will make you invest or walk away from investment?

Colleen: Many factors need to be aligned before we invest. Obviously, the team is the most important factor. We need to feel that the founding team is incredibly impressive and passionate. Also, that they are individuals that we wish to work with for a long time. Remember, this team, if successful, will be part of our portfolio for the next seven to eight years. We need to have a good relationship with the team so we can be proud to work for them. After that, it is a sharp cut. We need to see a clear product vision, an appetite to truly build an asset. It is very rare to find a CEO who is passionate, has a solid product vision, manages to take a product to market and then manages to zoom out and say “here is the roadmap” and realistically how we get to a billion-dollar evaluation. We find many amazing people that work in the 30,000 feet height with great product vision but they are not structured enough to execute. Or, we find people that are highly detail oriented, highly product centric that can’t get out from it and miss the forest from the trees.

Q: What is the expected return?

Colleen: We underwrite all investments with expectations of 10x.

Q: Can we expect 10x from Insurtech companies, is it too soon?

Colleen: Oh yes, for sure. It depends on when you invest. When looking at one of the big insurance exists - Esurance, it was in the billion-dollar neighborhood. If their investors made 10x, it depends on where they were in the capital stack.

Q: We see insurers venture arms getting into the market. Are they trying to micromanage the startups?

Colleen: It is tricky. We usually advise that companies consider several conditions before they take strategic money. For example, it depends on the stage. If you are an early stage, you don’t want to bring 'strategic money' for a high percentage of the cap table too soon, because the strategic can excerpt a large amount of control. And if you have only one strategic, that can actually be negative because you would like to go out and partner in the market. Let’s take Impact Health as an example. If I was Impact health and I had raised money from one strategic health insurance company, it would change how other insurers would work with me. Other insurers would start wondering if there is a preferred beneficial structure towards the carrier that gave me $5M. Maybe. When companies become more mature and start to think about an exit, that’s maybe a good time to have an enhanced relationship with a specific carrier. We usually advise companies not to take capital too soon from strategics.

Q: What is the common size of the founder team and how much equity is left after series A?

Colleen: The most common size is two or three founders. It is rare to see a solo founder. It certainly happens, but it’s very rare. When you have a round with four, or five founders that have equal shares, for us, it looks messy. Because at the end of the day, someone needs to be the CEO and make the decisions. As much as they think that everything is cool, and they are all equal, at the end of the day, when shit gets rough, ownership matters. I think that when the founders team is big, the CEO needs a clear ownership. Regarding series A - it is common to see that a company gives 20-25 percent equity towards series A.

Now, remember that it is contingent upon what happened before that. So, a company that raised $1 million in convertible notes on a $5 million cap is going to face a very different dilution compared to a company that raised $7M with a $20M cap. We have seen everything. It truly depends on the capital before series A. That is the ballpark, and you don’t want the founding team to come out of series A with less than 25-30 percent.