Bob Frady, co-founder and CEO of HazardHub.

HazardHub provides a comprehensive set of hazard risk and property data for every address in the United States.

Nick Lamparelli joined Gilad and the InsurTechLA community for an unscripted InsurTechTalk. In this broadcasted event, Nick was in the interviewee's seat. We had the opportunity to learn about Nick’s day job and dive into flood insurance and how to build insurance programs.

The 1996 movie ‘Scream’ taught us one thing: Don’t answer the phone! And much like the characters of that movie, so to insurers should heed this advice when engaging with Millennials.

A startup has a life but the people who breathe life into it…, well, they usually don't.

People like the idea of a startup. It is romantic. The excitement diminishes when they find out the extent of their responsibility and compensation. Basically, most people really want to work for Google. Google is a multibillion-dollar behemoth that has all the risk management tools and processes to support it. And yes! They still have all the perks and cool parties at the end of Google I/O.

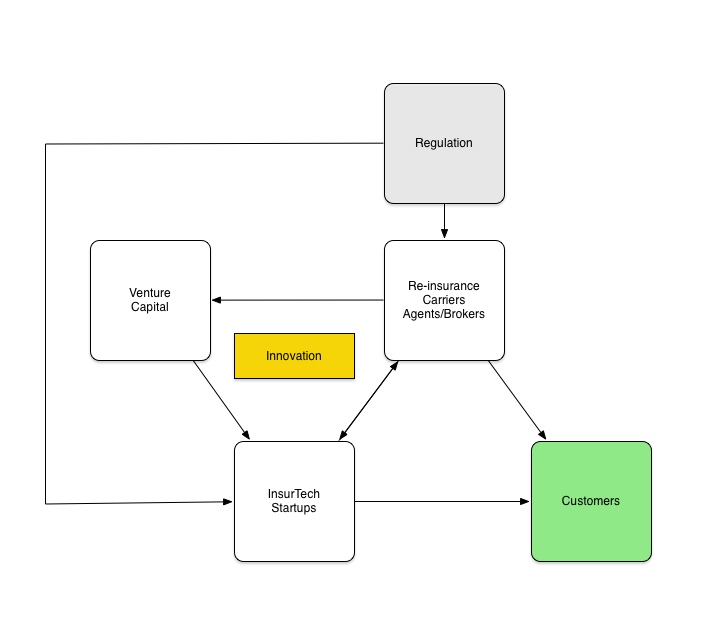

The entrance of startups to the insurance industry, nearly four years ago (2015), introduced a change, innovation, that made all the components, whether they are linear or passive, to react. The new teen spirit that the startup introduced acted as a step function that increased the value of the industry. The input may be a nice and clean function. It has a ripple effect that affects the entire pond until is converges on the new and higher level.

Bob Frady, co-founder and CEO of HazardHub.

HazardHub provides a comprehensive set of hazard risk and property data for every address in the United States.

2017 has been an interesting year for InsurTech. I would define it as the year that InsurTech took another step from adolescence towards adulthood. I define "adolescence" as the time that the youth exhibits exploration, rebellious and self-definition behavior. The players in the industry are still figuring out the rules of the game, they are defining the frameworks and the majority do not know what to do with it all.

My dear friends Shefi and Avi from Coverager gathered the following information on investors and investment in the global insurance industry. For additional information and segmentation by continents. Checkout Shefi's article.

The investments' volume is stabilizing similar to the trend that we witnessed in FinTech (a CBInsight graph should be here.) An interesting fact is the amounts that the investors put into the more established companies such as Lemonade and DataRobot and the brand new startups. Why is it interesting? Very simple, SoftBank invested $120M series C in Lemonade and New Enterprise Associates invested $67M series C in DataRobot. Both investors understand the cost of doing business in the insurance industry and each investor has an investment strategy. Take a look at SoftBank's portfolio here. Lemonade needs the capital in order to grow as an insurance carrier to new territory leveraging its scalable core system, and DataRobot needs to expand its enterprise sales force.

The insurance companies and the reinsurance companies took several steps forward as well to embrace the change and opportunity that the newcomers bring. One indicator was the number of participants at Jay Weintraub's ITC2017 conference. 3,800 attended the conference, double the number of the ITC2016 conference. Another indicator is the increasing number of venture arms. In 2015, the European insurers had the lead with AXA, Allianz, and Aviva who created a venture arm and XL Catlin as the only US-based insurer with a venture arm. In 2016, additional US insurers founded their venture arm Nationwide $100M, Liberty Mutual $150M and Intact (Canada) $200. In 2017, Northwestern Mutual launched its venture arm and many others got the spotlight, for example, RGAx, Aflac ventures, and BlueCross ventures. Others increased the size, scope, and talent of their innovation team e.g. AIG.

We can't ignore the buzz words and trends that shaped 2017 tech world. I think that we can all agree that AI, blockchain, bitcoin, ICO, and bots were the 2017-Q3 Q4 buzzwords that eclipsed the Q1-Q2 buzzwords predictive analytics, big data, and customer engagement. Bear in mind that in many insurance companies the phrases "digital transformation", "agile", "mobile first" etc are work in progress and the mid-size agencies, who are a major player in the distribution channel, are not digitized as they should.

Not everything is Distribution or new insurance products. The SaaS, the DaaS and the smart compare engines that have done well. We can't go without mentioning CrapeData, DataRobot, PolicyGenius, and BoldPenguin.

There are new and exciting hardcore technologies coming out from innovation centers and from the Cyber powerhouse Israel. The space is not defined enough for an underwriting, pricing and the standards that can provide significant recovery through the claims process. In 2018, we are going to see new insurance products that can address the combined risk of system and human. We are at the start of cyber insurance.

No, blockchain will not fall -- the excitement will wind down. The engine that drives the research and searches for revenue-driving applications will continue. We going to witness additional institutes (research and consortium) that will help the carriers to improve on internal processes.

In 2018 we are going to the chatter around Smart Cities. Why? Because Singapore, Dubai, Amsterdam, Barcelona and other cities are exploring the concept.

A smart city is an urban area that uses different types of electronic data collection sensors to supply information which is used to manage assets and resources efficiently. --Wikipedia

Insurance will benefit from smart cities in the future. Safer urban areas, better risk management, and easier CAT assessments. In the meanwhile, it is important to observe the IoT operation that will power the Smart City and the cyber security + cyber insurance that it may require.

No, unless you don't have one.

Application Programming Interface (API) is THE 2018 prediction for me. Carriers know that the marginal cost of adding another "digital agent" can cost them millions if they don't have a modern API management system. Insurance companies want to work and receive business from the new InsurTech startups who registered as agents in all 50 states and with the agents who digitized their own business.

The core entrepreneurs of the insurance industry. The agents will have two paths to take (i) evolve to an InsurTech agency (ii) buy InsurTech services to make their agency more productive and more efficient. In 2018, the agents will be the buying force of InsurTech products.

In 2018, InsurTech startups are going to enter new stages of a venture's life cycle. Scale - startups are going to invest their series A and B and scale their operation, customer base and revenue. Acquisition - for market segment, technology and talent. Dissolve - because they had the wrong product, the wrong team, the wrong business model, or that their competitors were better.

The March 13th Los Angeles InsurTech meetup “Founders Talk” started with a left foot when a dense fog fell over LAX and canceled the flight from SFO of our speaker, Christine Carrillo's, CEO of Impact Health. Luckily, our second speaker, Max Drucker, CEO of Carpe Data, stepped up to the plate and kept the audience fascinated about the topic of InsurTech for an hour and a half. Thanks to Max and all participants the meetup was a great success.

The format of the evening was not a traditional talk, rather more of a living room chat. Max was sitting on the sofa surrounded by the guests. There were neither slides, nor presentations. To start the evening, Max described his and Carpe Data’s (https://carpe.io) background. Then, we continued with a chat.

Carpe Data gathers and aggregates data from from Yelp, Osha, Glassdoor, crime-databases, Twitter, and other data sources. Carpe cleans the aggregated data, builds models on it and sells it to the insurance companies. A good example is how Carpe Data serves commercial insurance. Let's take a restaurant as an example. Carpe analyses the business’s website, checks if it has a happy hour, a deep fryer, hours of operation and crunches more data points, and delivers a clean data set for the insurers to consume.

Max recognizes several value offers:

- Pre-filling applications that helps pre-qualifications

- Qualification validation based on multi sourced data

- Insurance/risk score for small business that allows a better decision making when adding a business to the book

- Something in the data points

- Provide data to underwriters

Q: How much of this is, or will, take the commercial underwriter out of the picture? How much of it is automated?

A: If you ask any carrier about their commercial, or small commercial, they will say that it is automated. None of them automate, except for the really really small stuff and then they don’t validate the data. They are passing data through rules and hope for the best. I think that they look at the disruption in the auto insurance and think how they can take it to commercial.

Carriers should take a look at the operation of commercial underwriting and its input. I ask “how many underwriters use Google street view and how many visit the property?”.

Q: How is the investor echo system reacting to this new trend in InsurTech?

A: It is insane. In the past year there were legit 5-6 conferences. They try to apply what they know from SaaS into insurance. The prize is big, but the sales cycle is very long and there is no predicting it. It is hard, unpredictable and a turn-off. I told investors that “if you have this entrepreneur that had a success and now he wants to import it to insurance... He is wrong, he will fail”. Many investors see it as the last “white space”. Others focus on the distribution like Lemonade, Trov, Quilt, Goji, Ladder Life and more. Most of them are basically agents that re-sell insurance and try to put on it a better UI.

I don’t think that insurance has a branding problem, and I don’t think that people hate their insurance. I think that people like Farmers, All-State and Progressive. I don’t think that the distribution will be the great disruptor of the insurance industry. But, most of the money is there.

Q: What about global insurance for professionals who travel and work from various countries?

A: I don’t know. There will be more and more new insurance products that will need to compensate for the shrinking of the auto insurance in the near future. Pet insurance is a great example for a booming product that surfaced in the recent years.

Q: How your customers in the IT departments respond to this change? (data services)

A: Some actuary groups try to do a little bit from this and a little bit of that. They don’t want to build their own API connector. They don’t want to tap and pull data from 50 new APIs. They will have couple of data scientists that will do it as an experiment, but that is where they’ll stop. They want, and like, to buy data. For example, Lexis sells data to insurance companies in billions of dollars. The IT departments care about data, and getting the data.

Q: Do you collect data regarding cyber security?

A: That’s a great question. One of the product ideas that I thought about, which we don’t do, is specifically for cyber security and cyber insurance. There are companies that sell data about IT stacks and they understand what the company is using internally and externally. Are they using Salesforce? What kind of firewall? Or are they using AWS? And as far as I can tell, cyber insurance, base their price on non-sense. There is no bases or anything. They don’t check if you have the latest patch, or if you are running Ubuntu, or what ever. They don’t ask these questions. They ask “what is your revenue -- ahh the price is $2,000 a year”. I think it is a good opportunity.

Q: What is your recommendation to the entrepreneurs in the audience?

A: My recommendation to entrepreneurs who want to go to insurTech is go and work for an insurance company. In one minute you will recognize a thousand opportunities to disrupt. You need to figure out what are they doing wrong. Then, you want to learn as much as you can how it works and then you’ll go and build the right thing and sell it back. Insurance carriers don’t abuse vendors, they have a slow procurement cycle that you need to know and accept. They are not horrible to work with, they are just rational and risk averse. I will suggest to get experience with an insurance company. I think that the best thing is to go work for one. It will be a huge differentiator to start a company that tries to serve insurance carriers after actually working for an insurance company. There are so many startups out there that don’t know anything about insurance.

Q: Why is the sales cycle so long?

A: People will often say that the insurance companies are risk averse. But, also, the deals are very big. The size of the business rather than the aspect of it is the factor that adds to the time length. You need to learn and understand the process. It takes 3 months to get the business unit engaged, once they are engaged, they will send you over to IT. IT will look at it for another 3-4 months for validation. Then procurement will process it for 3 months. Once you get the work order, the company will need to train everyone and that will take another 3 months. And that doesn’t include an internal campaign that takes 3 months. Going back to the opportunity, if you have the patience and the understanding of the process you have an advantage.

Q: How the investors react to this reality?

A: Some understand, others don’t. They will ask “I’ll bring these superstar salespersons, do you think they can accelerate the sales process?”. The answer is “no, it is what it is”.

Q: How the millennial and the gen-Y consume insurance?

A: They don’t buy life insurance! This is a big thing. They were not taught about it at school, they don’t know about it. Employers used to provide it - not anymore. Government jobs used to provide it - not anymore. I do think that young people will not buy car insurance. That is a tipping point. The first part of this tipping point will be a dramatic differences between premiums for cars, which are safe thanks to auto pilot technology and cars without the technology. The second part is that Tesla, or Mercedes, or another self driving car will kill somebody and his family will sue the insurance company. The insurance company, then, will sue Tesla. Then everything will change. Tesla will say - you buy a car and the insurance from us, you will get everything from Tesla. They should do that because they are already on the hook for liability.

BTW - what is safer? A 16 years old driving a car or an Uber driver?

Q: We are looking at all these data points for underwriting 1 to 1 scale. Do you think it will apply for a risk pool? Do you think these techniques will scale?

A: Probably. Look at group health application and compensation in general. I am better at 1:1 ratio. Carriers use us to buy a book of business, because we can look at the risk differently. So a book will be a bundle of risks and we can look at how much a package of risk is worth. And we can point to several policies that they should not buy.

Q: Are you looking into reinsurance?

A: The re-insurance are lighting up the investment world. They have invested hundreds of millions of dollars over the past couple of years. They love innovation and they wish to run pilots. If that pilot is successful they will incentivize their carrier partners to use your technology. It is too soon to tell. They are trying.

Q: Are they fishing?

A: Maybe. There is a rumor that they see all the new digital insurers and want to go in for themselves.

Thank you to Kinvey and Carbon Five that helped to setup the event