Happy 2019!

Yes! I am a little bit late. This article has been sitting in my drafts-box for couple of months now. I considered a friend’s advise to skip this article and jump directly to “Q1 2019 recap.” Yes, but, well.. I’ll do it in Q3.

I can hope that 2019 will be as exciting as in 2018. I know, it is a bold statement. Let’s face it, the insurance industry turned into an exciting space with brands and semi-celebs. There are several KPI to measure internal engagement in the industry to its various components.

If you see an increase in the number of:

Number of podcasts

Coverager’s subscriptions

InsNerds Slack members and threads

ITC, Dig-In and OnRamp participants in the USA

New conferences and new faces

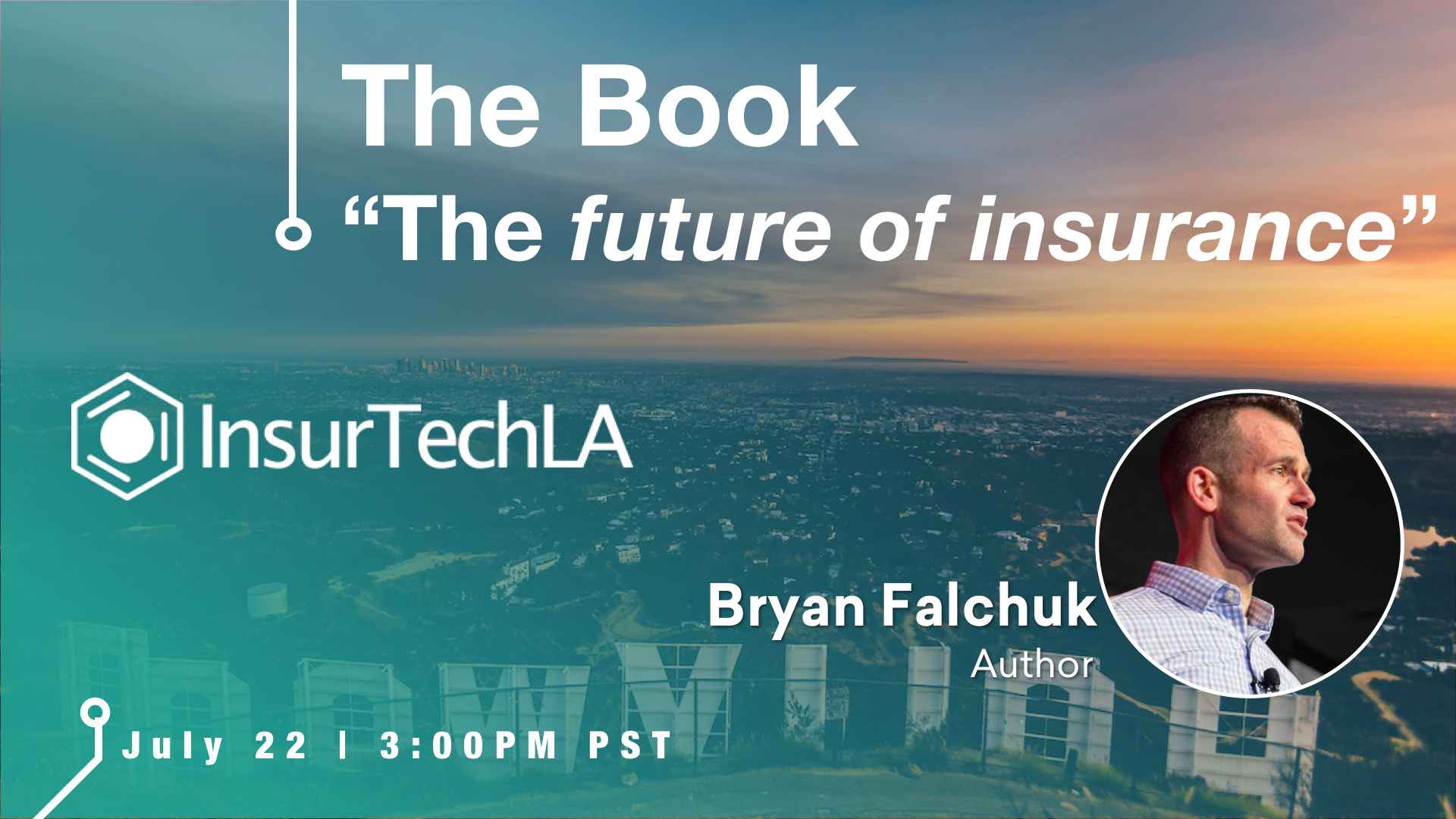

Personally, it was a year of change. I left Farmers insurance, co-authored the “The InsurTech Book,” founded BOUND, joined the advisory board of DropIn and continued to run InsurTech-LA. Also, I had the honor to take part in Lloyd’s of London’s first Lloyd’s Lab cohort, moderate several panels and have a beer/coffee with many of you.

Other reflection on 2019

I highly recommend reading the 2019 predictions by Martha Notaras, Nigel Walsh and Stephen Goldstein. https://www.linkedin.com/pulse/10-insurtech-predictions-2019-martha-notaras

https://www.rgax.com/blog/insurtech-predictions-2019

https://www.linkedin.com/pulse/2019-year-ahead-nigel-walsh/

Reflection on 2018

http://www.insurtech.me/blog/2018/1/7/2018-predictions

I am going to keep this short.

1. CYBER INSURANCE

2018 we saw new companies entering the space. There are still coverage gaps and most of the products are on the same path. My prediction was that it is the start of filling substance behind the “buzz.” I’ll mark it as 1/1

2. THE FALL OF BLOCKCHAIN

No, blockchain did fall -- the excitement did wind down (as we predicted). Two indicators were the slow down to almost a halt of startup pitches that started with “it is an X running on blockchain” and blockchain sessions in a conference. The consortiums and other research institutes are at work and still have funds to continue their work for 2019. I haven’t seen a product that is based on blockchain that reached commercial use. 2/2

3. SMART CITIES

The chatter around Smart Cities in the context of insurance started. 3/3

4. ARE BOTS STILL A THING?

Yes, they are. The question is - do we compare them with a static form as a UX unit or one against the other on AI and NLP capability. 3.5/4

5. API

Application Programming Interface (API) is THE 2018 prediction for me. Carriers know that the marginal cost of adding another "digital agent" can cost them millions if they don't have a modern API management system. Insurance companies want to work and receive business from the new InsurTech startups who registered as agents in all 50 states and with the agents who digitized their own business.

6. AGENTS

The core entrepreneurs of the insurance industry. The agents will have two paths to take (i) evolve to an InsurTech agency (ii) buy InsurTech services to make their agency more productive and more efficient. In 2018, the agents will be the buying force of InsurTech products.

7. VENTURE LIFE CYCLE

In 2018, InsurTech startups are going to enter new stages of a venture's life cycle. Scale - startups are going to invest their series A and B and scale their operation, customer base and revenue. Acquisition - for the market segment, technology, and talent. Dissolve - because they had the wrong product, the wrong team, the wrong business model, or that their competitors were better.